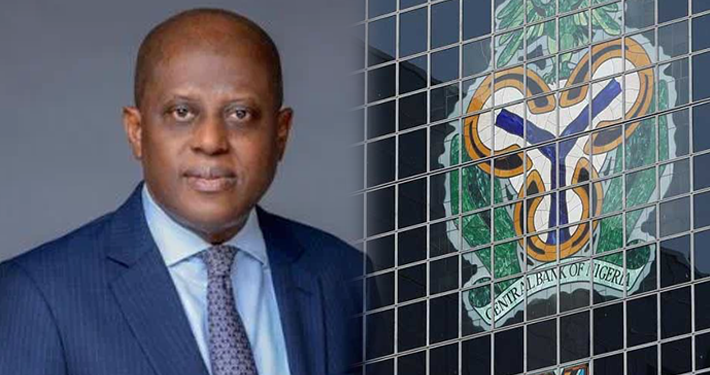

More than 22 Nigerian Banks Meet CBN Recapitalisation Thresholds Ahead of 2026

Sterling Bank, Ecobank, 22 Others Meet CBN Recapitalisation Thresholds Ahead of 2026 Nigeria’s banking sector is set for renewed strength as Sterling Bank, Ecobank, and 22 other financial institutions have successfully met the Central Bank of Nigeria’s (CBN) revised recapitalisation requirements, well ahead of the March 31, 2026 compliance deadline. The milestone marks a significant step in the CBN’s effort to strengthen the resilience of the financial system, improve banks’ capacity to absorb economic shocks, and position the sector to better support national economic growth and stability. The recapitalisation programme, which commenced in 2024, requires commercial banks with international authorisation…