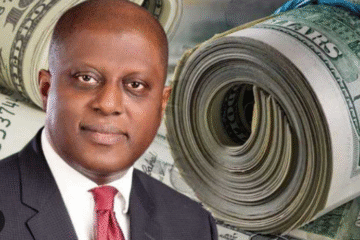

Nigeria’s foreign capital inflows have hit a record high, reaching $20.98 billion in the first ten months of 2025, according to Central Bank Governor Olayemi Cardoso. This represents a significant 70% increase compared to the total for 2024 and a staggering 428% jump from the $3.9 billion recorded in 2023.

Cardoso attributed this remarkable growth to strengthened macroeconomic management, foreign exchange market reforms, and improved transparency across the financial system. He made this disclosure at the 60th Annual Bankers’ Dinner in Lagos, highlighting the renewed appetite for Nigerian assets.

The CBN governor also reported significant improvements in the country’s external buffers, with foreign reserves rising to $46.7 billion by mid-November, the highest in almost seven years, providing over 10 months of forward import cover. This growth is driven by improved market functioning, stronger non-oil exports, and robust capital inflows.

Key Highlights:

- Foreign Capital Inflows: $20.98 billion (January-October 2025)

- Increase from 2024: 70%

- Increase from 2023: 428%

- Foreign Reserves: $46.7 billion (mid-November 2025)

- Current Account Balance: $5.28 billion (Q2 2025), up 85% from Q1

Cardoso emphasized that Nigeria’s flexible FX regime, rising non-oil exports, and expanding services trade now offer stronger protection against external shocks. The CBN has also maintained a unified exchange-rate system, cleared the multi-billion-dollar FX backlog, and introduced transparency measures.

The governor reiterated the CBN’s commitment to price stability, forward guidance, and leveraging technology to strengthen decision-making. He outlined strategic priorities for 2026, including strengthening banking supervision, delivering durable price stability, and modernizing payments.